March 8, 2013

Downe Writes to Minister Shea Urging Cooperation with Parliamentary Budget Office

Charlottetown Senator Percy Downe has written to Revenue Minister Gail Shea calling upon her to reverse her position and allow Parliamentary Budget Officer Kevin Page access to the information he requires to estimate the size of the “tax gap” in Canada (the difference between what is owed in taxes and what is actually collected).

“According to the Organization for Economic Cooperation and Development, a dozen OECD member countries* compile periodic estimates of the tax gap”, said Senator Downe. “Kevin Page has indicated that it is possible to do the same thing in Canada, however, he needs information currently held by the Canada Revenue Agency, which the Agency has been unwilling to share.”

In his letter, Downe calls upon Minister Shea to “change (CRA) policy and to allow the Canada Revenue Agency to provide the Parliamentary Budget Office with the information he needs to do his job.”

(*Belgium, Chile, the Czech Republic, Denmark, Estonia, France, Greece, Israel, Italy, Spain, the United Kingdom, the United States)

Enclosed: Letter to Minister Gail Shea, March 7, 2013

For further information:

Senator Percy Downe: 613-943-8107

Or toll free at 1-800-267-7362

www.sen.parl.gc.ca/pdowne

March 7, 2013

Honourable Gail Shea, P.C., M.P.

Minister of National Revenue

555 MacKenzie Avenue, 7th Floor

Ottawa ON K1A 0L5

Dear Minister Shea:

As you know, for some time I have been studying the problem of overseas tax evasion. As with any problem, understanding its nature and scale is the first step toward solving it. With that in mind, in October of last year, I wrote the Parliamentary Budget Officer asking him to investigate the possibility of determining the “tax gap” (the difference between what is owed in taxes and what is actually collected). After diligent effort, his office has determined that it is indeed possible to provide an estimate of the gap.

Examination of other countries’ experiences (a dozen OECD member countries compile periodic estimates of the gap, including the United Kingdom, Chile, Israel and the United States) has led him to the conclusion that a “Bottom Up” assessment would be most appropriate for Canada:

“Bottom up”: Relying on random sampling of actual tax returns and follow-up reassessments/audits by the Tax Administration Authority (i.e., comparing what taxpayers originally file compared to the liability actually assessed.

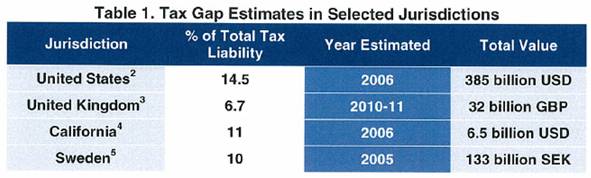

Therefore, it is in fact possible to estimate the gap between what is owed and what is collected. Such an estimate would, by definition, not be a precise description of the problem, but other jurisdictions have found it worth the effort. For example, Mr. Page has made public the following table:

However, to provide such an estimate, certain information is required; information that can only come from the Canada Revenue Agency. In particular, he requires:

- A random sample of T1 and T2 tax filers; in the case of the latter, preferably segmented by firm size.

- The value of additional revenue assessed as a result of the audit of the relevant types of income reported on these files (e.g. initial filing and audited assessments of employment, capital gains, dividend and interest income).

- Estimates regarding the “collectability” of resulting reassessments.

- Estimates regarding the rates of “non-detection” of incorrect returns through audit.

In the words of Oxford economist Paul Collier in his testimony before the House of Commons Finance Committee, attaching a number to the amount of tax revenue not collected “would certainly concentrate the mind, if you realized that you're losing a lot of money here”. If for no other reason, I believe that such an estimate would be a valuable contribution to the burgeoning dialogue regarding tax evasion and avoidance.

Unfortunately, officials at CRA appear to have little interest in furthering that dialogue. Repeated requests by the Parliamentary Budget Officer for information have been met with claims that CRA is “unable” to share the relevant data with the PBO. This is unacceptable.

Policy cannot be made, nor can it be evaluated or improved, without data. The Parliamentary Budget Officer needs – and the Canadian people deserve – to know if Canadians’ tax dollars are being collected wisely, just as surely as they need to know that they are being spent wisely.

I call upon you to change your policy and allow the Canada Revenue Agency to provide the Parliamentary Budget Officer with the information he needs to do his job.

Sincerely,

Original signed by

Percy E. Downe

Senator |