Tuesday, December 14, 2010

$12,000,000 in a Single Account, and Still No Charges Laid

New information on Canadian tax evaders in Liechtenstein

Four years after the Canadian government was given the names of 106 Canadians with undeclared bank accounts in Liechtenstein, the Harper government has now confirmed that not one person has been fined or charged with tax evasion. Unlike Germany, the United States and a host of other countries, the Canadian Government has decided to not impose any fines, or charge anyone.

Canadians are wondering who the Harper Government is protecting.

In response to inquiries by Charlottetown Senator Percy Downe, the Government also admitted that the amounts in Canadian-held Liechtenstein bank accounts totalled over $100 million ranging from a minimum of $500,000 to one account with over $12 million.

Any ordinary Canadian who is found to have undeclared bank accounts and is not declaring their income would be hounded by the Canadian Revenue Agency, charged and fined. Why the double standard for very rich Canadians with foreign bank accounts hidden in well-known tax havens?

“Canadians using banks in our country pay all of their taxes. Why are Canadians with foreign bank accounts – some containing millions of dollars – getting a tax holiday under this government? Who is being protected?” asked Downe.

When Downe first raised this issue, the Federal Government was full of promises and tough talk. In 2009, then Revenue Minister Jean-Pierre Blackburn said “People realized that it’s a question of time before we get them,” (…) “I tell them ‘[W]e’ll get you, we’ll find you.’” (Times – Colonist. Victoria, B.C.: Dec. 3, 2009) Earlier in the year he had called tax evasion “a huge problem for this country,” and vowed “[I]f somebody owes us something, we have to get it.” (Saskatoon Star Phoenix, Feb. 19, 2009).

Since 2007, the results have fallen short of the rhetoric. The Canada Revenue Agency claims to have recovered approximately $6 million in back taxes, interest and penalties. Given that the total amount of money hidden away was over $100 million – with $12 million in one account alone - this is a failure of colossal proportions.

And amid the talk of interest and penalties, another fact becomes clear: not one penny has been assessed in fines. That is because not one charge has been laid. In the four years since this information has come to light, not one of these Canadians who have hidden their money overseas has stood before a judge, in Canada or overseas.

At one point, then Revenue Minister Jean-Pierre Blackburn said he expected the Government would receive up to $20 million in taxes and penalties (“Canada Revenue probe focuses on some RBC DS clients”, CBC News, December 14, 2009), however, the government has collected nowhere near that amount and Canadians are wondering if Stephen Harper’s promise that tax evaders “will face the full force of Canadian law” (Hansard, Sept.30, 2010) will be backed up by any action other than reassuring words.

Attached: Reply to Written Questions tabled by the Government of Canada, December 2010

Reply Tabled by the Government of Canada

December 2010

With regard to the Canada Revenue Agency’s (CRA) investigation of cases of possible tax evasion in Liechtenstein:

The Canada Revenue Agency (CRA) noted that as of June 10, 2010, twenty six audit cases had been completed with a resulting assessment of approximately $5.2 million,

With respect to the $5.2 million dollars, taking into account all taxes, interest, fines and penalties as calculated by the CRA systems built-in logic for abatements, varying interest rates over time and other automatic adjustments, as of October 20, 2010 (i.e., the date of the question), the amount the CRA assessed on these 26 closed audit cases is now $5.8 million. Therefore, it is important to note that information has been provided, in the manner requested, based on these 26 closed audit cases and the $5.8 million assessed.

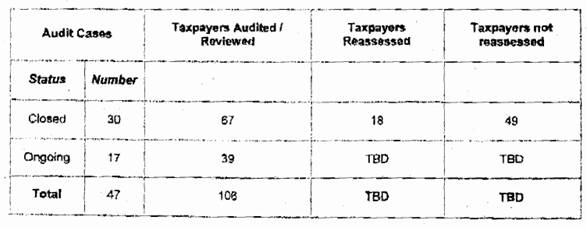

Please note that as of October 20, 2010, there are thirty closed audit cases and seventeen on-going audits, for a total number of forty-seven audit cases (please see part (n)).

Part (a): Per the explanation provided in the preamble, the total amount assessed on the 26 cases is $5.8 million.

(a) for the 26 cases reassessed by the CRA as of June 10, 2010, what is the breakdown of the $5.2 million

(i) in unpaid taxes,

The $5.8 million assessed includes $1.447 million in newly-assessed taxes as a result of the compliance (audit) action.

(ii) in interest,

The $5.8 million amount includes $1,852 million in interest. The latter figure includes all interest paid on cases which had already been settled in full by the taxpayer before October 20, 2010 (i.e. the date of the question), and all interest accrued up to October 20, 2010, on cases where there was still an outstanding balance as of that date.

(iii) in fines,

As no charges have been laid, no fines have been assessed.

(iv) in penalties;

The $5.8 million amount includes $2.503 million in penalties.

(b) how much of the $5.2 million has been collected;

As of October 20, 2010, $6,023 million had been collected on the 26 cases.

(c) how many of the 26 cases are under appeal;

As of October 20, 2010, the CRA can validate that 2 taxpayers have filed a notice of objection with respect to these cases and that no notice of appeal has been filed.

(d) how many of the 26 cases remain open;

As of October 20, 2010, 17 cases remained open,

(e) in how many of the 26 cases has the CRA collected the full amount of taxes, interest, fines and penalties owed;

As of October 20, 2010, 23 of the 26 completed cases had been settled in full (i.e., all taxes, interest, and penalties resulting from the compliance action had been collected):

(f) for each case identified in (e) how much was collected

(i) in taxes,

Total collected in taxes related to the 23 cases: $1.343 million.

(ii) in interest,

Total collected in interest related to the 23 cases: $1.218 million.

(iii) in fines,

Please see Part (e) (ill),

(v) in penalties;

Total collected in penalties related to the 23 cases: $ 1.337 million

(g) how many of the account holders in the 26 cases have made partial payment;

As of October 20, 2010, 3 of the 26 completed cases had not been fully settled. In each of these 3 cases, the amount of taxes had been collected in full, but the interest and penalties resulting from the compliance action had not been completely collected.

(h) of the partial repayments made

(i) what was the largest repayment,

Of the 3 cases where the amounts owing had only been partially collected the largest amount collected was $602,736.50.

(ii) what was the smallest repayment,

Of the 3 cases where the amounts awing had only been partially collected the smallest amount collected was $117,506.24.

(iii) what was the average repayment;

Of the 3 cases where the amounts owing had only been partially collected, the average amount collected was $375,383.72.

(i) how much does the CRA anticipate it has yet to collect

As of October 20, 2010, the total amount remaining to be collected on the 26 completed cases (i.e., on the 3 cases where the amounts owing had only been partially collected. as described in part (g)) was$779,344.72.

(i) in taxes,

All tax amounts had been collected on the 26 cases,

(ii) in interest,

The amount of interest remaining to be collected was $247,514.19.

(iii) in fines,

Please see Part (a) (iii),

(iv) in penalties;

The amount of penalties remaining to be collected was $531,830.53.

(j) of the amounts of money contained in the Liechtenstein accounts declared to or discovered by the CRA, what was

(i) the largest amount,

The largest bank account balance was $12,000,000 CDN.

(ii) the smallest amount,

The smallest bank account balance was $500,000 CDN,

(iii) the average amount;

The answer cannot be provided in the manner requested as the bank account balances were

provided in 5 currencies, in order to establish an accurate average, a conversion of all account balances to one currency at a point in time would be required.

(k) on what date was the CRA first made aware of the names of Canadians with accounts in Liechtenstein;

The CRA was first made aware of the 106 names of Canadians with accounts in Liechtenstein in March 2007.

(l) on what date did CRA begin its investigation;

The term "investigation" carries a specific meaning in the context of CRA which may differ from that asexpressed in the question. Therefore, the CRA may only confirm that it began its analysis of the information in March 2007.

(m) on what date did the first audit of an individual account holder begin;

The first audit began in May 29, 2007,

(n) of the 106 Canadians identified as having bank accounts in Liechtenstein, how many have

(i) had their accounts audited,

(ii) not had their accounts audited,

(iii) had their accounts reassessed,

(iv) not had their accounts reassessed,

(vi) been the subject of a compliance action,

(vii) not been the subject of a compliance action; and

106 Canadians were identified as being linked to bank accounts in Liechtenstein. All 106 taxpayers were subject to some level of compliance action. As of June 10, 2010, 26 audit cases had been completed.

As noted in the preamble, the following table reflects the total number of audits (comp/steel and on-going) as of October 20, 2010:

(o) how many tax evasion charges have been laid?

No tax evasion charges have been laid

For further information:

Senator Percy Downe: 613-943-8107

Or toll free at 1-800-267-7362

www.sen.parl.gc.ca/pdowne |